what is sales tax in tampa

Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the Florida Department of Revenue. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

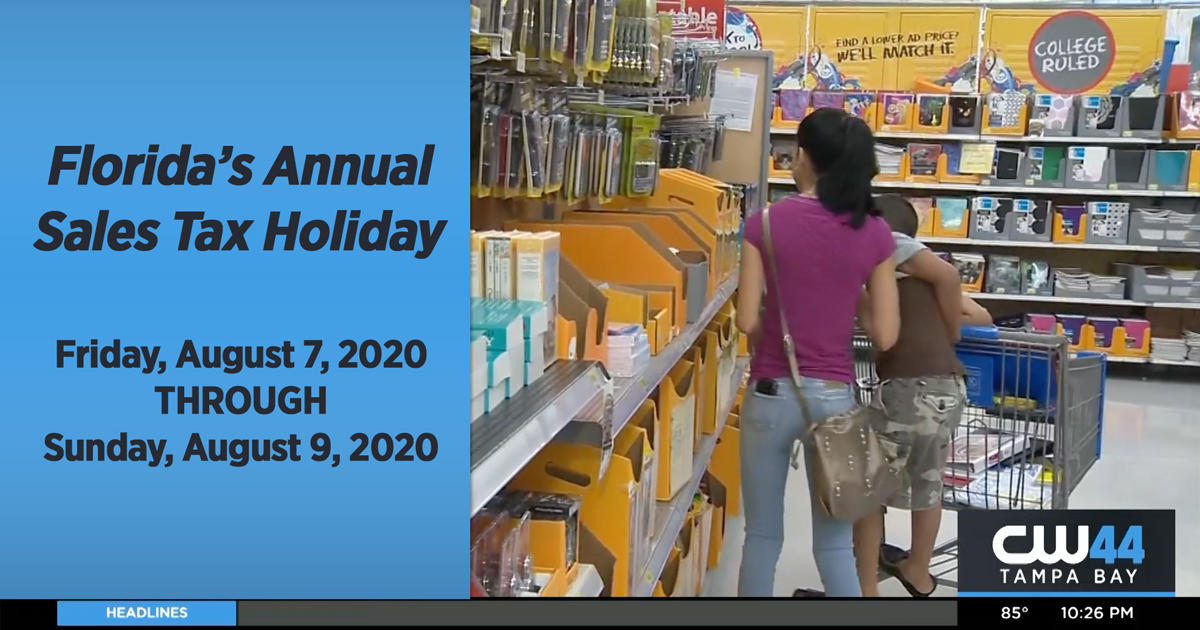

2020 Back To School Florida Sales Tax Holiday Is This Weekend Cw Tampa

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

. The minimum combined 2022 sales tax rate for Hillsborough County Florida is. There is no applicable city. The requirement for business owners in the State of Florida to collect and remit sales.

The 6 state sales tax applies to the full purchase price and the 1. What salary does a Sales Tax earn in Tampa. The minimum combined 2022 sales tax rate for Tampa Kansas is.

Counties and cities can. 2020 rates included for use while preparing your income tax deduction. What is the sales tax rate in Hillsborough County.

Lemon Street Municipal Office Building. The average cumulative sales tax rate in Tampa Florida is 75. What is the sales tax rate in Tampa Florida.

Tampa is located within Hillsborough County. This is the total of state county and city sales tax rates. The latest sales tax rate for Tampa FL.

This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was 8500. The Hillsborough county and Tampa sales tax rate is 75.

Florida has recent rate changes Thu Jul 01 2021. 4900 W Lemon Street. Business Tax Supervisor.

The 75 sales tax rate in Tampa consists of 6 Florida state sales tax and 15 Hillsborough County sales tax. What is the sales tax in Pinellas County FL. Tampa collects the maximum legal local sales tax.

The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. Sales tax is a tax paid to a governing body for the sale of certain goods and services. This rate includes any state county city and local sales taxes.

Floridas general state sales tax rate is 6 with the following exceptions. This includes the rates on the state county city and special levels. Average Sales Tax With Local.

With local taxes the total sales tax rate is between 6000 and 7500. Several examples of exceptions to this tax are certain. There are a total.

Floridas general state sales tax rate is 6 with the following exceptions. This is the total of state county and city sales tax rates. The full price was 30000 but you received a trade-in value of 5000 a manufacturers rebate of 500 and a dealer incentive of 1000.

551 Sales Tax Salaries in Tampa provided anonymously by employees. What is the sales tax rate in Tampa Kansas. In the state of Florida sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15. The minimum combined 2022 sales tax rate for Tampa Florida is.

Groceries and prescription drugs are exempt from the Florida sales tax. Business LicenseTax Renewal Payments Business Tax Record Inquiries Federal Taxes Internal Revenue Service Property Tax Payments Hillsborough County Property Tax. You would pay 23500 for the.

Select the Florida city from the list of popular cities.

Hillsborough County Transportation Gets The Green Light Tampa Bay Business Journal

Tampa Chamber Goes All In For Hillsborough Education Tax

Florida Amends Sales Tax On Commercial Real Estate Tampa Commercial Real Estate Florida Commercial Property

Judge Strikes Down Proposed 1 Sales Tax Increase Referendum

Db Packing Sales Tax Www Jltampa Org

Eye On Tampa Bay Media Suppresses Information To Cheerlead For Vinik S 14 Transit Sales Tax Hike

Hyde Park Cafe Once One Of South Tampa S Hottest Nightclubs Is Facing 200 000 In Delinquent Sales Tax And Unemployment Tax Tampa Bay Business Journal

Plans Move Forward On Where Transportation Sales Tax Will Go

Three School Districts Make The Case For A Sales Tax Wusf Public Media

Five Sales Tax Holidays Begin On July 1 What You Need To Know Youtube

Orange County Faces Proposed Sales Tax Increase In November Florida Daily

Idaho Sales Tax Rate Rates Calculator Avalara

Sales Tax No Tax For Tracks Florida

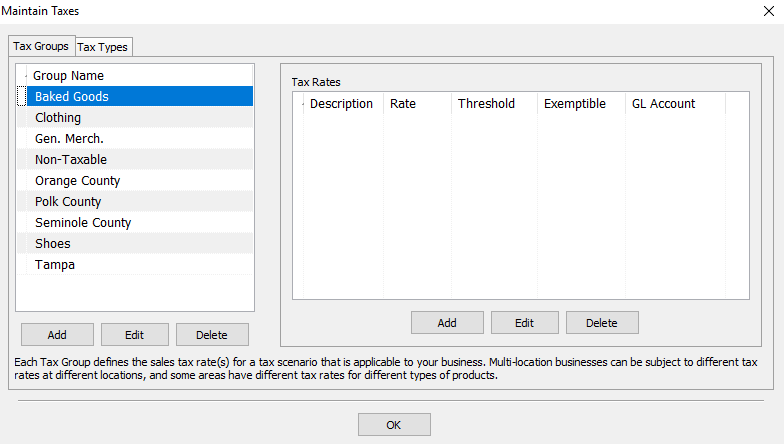

Setting Up Tax Codes Tax Groups And Tax Rates

2019 Sales Tax Holidays Back To School Tax Free Weekends

Tampa Bay Referendums Include Public School Funding Transit Tax And Environmental Land Protection Wusf Public Media

Judge Rules Penny Sales Tax Invalidated By Florida Supreme Court Must Be Used On Hillsborough Transportation