montgomery county maryland earned income tax credit

See Marylands EITC information. To apply call 1-800-944-7403 or go on the web to httpsdatmarylandgov click on forms scroll down the page and click on.

Montgomery County Volunteer Income Tax Assistance Program Vita

If you file with.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/tronc/F5RB5OL33VASBDWDAHPZT6YBGE.jpg)

. We dont make judgments or prescribe specific policies. This County program grants a credit against the county real property tax in order to offset in whole or in part increases in the county income tax revenues resulting from a county income. Maryland Earned Income Tax Credit EITC Rates.

50 of federal EITC 1 Eligibility Requirements. Montgomery County Division of Treasury 27 Courthouse Square Suite 200 Rockville MD 20850 By Online Ticket By phone. E-File directly to the IRS.

The credit starts at 32 of the federal credit allowed but is phased out for taxpayers with federal adjusted gross incomes above 95900 149050 for individuals who are married filing joint. If you earn less than 57000 per year you can get free help preparing your Maryland income tax return through the CASH. Tips Services To Get More Back From Income Tax Credit.

You may be eligible to claim an earned income tax credit on your 2021 federal and state tax returns if both your federal adjusted gross income and your earned income are less than. Free Tax Help Available for Income-Eligible Montgomery County Residents. It is important to note that Montgomery County is the only county in Maryland that offers a local income tax credit for its residents with a 100 percent match of the state earned.

Ad Guaranteed maximum refund. More information on EITC can be found online at the Comptroller of Maryland the Internal Revenue Service IRS CASH Campaign of Maryland or by calling the following. Thursday June 30 2022.

Ad Get the most out of your income tax refund. Earned Income Tax Credit EITC is a unique tax credit that puts money back into the pockets of low-and moderate-income workers. Montgomery County Council unanimously approved the Working Families Income Supplement Bill which alters certain requirements for residents to qualify for the Working.

July 2005 Montgomery County. See what makes us different. The EITC makes work pay.

The Maryland Thurgood Marshall State Law Library a court-related agency of the Maryland Judiciary sponsors this site. This years historic expansion of the federal. If you earned less than 58000 in 2021 you may qualify for the federal Maryland and Montgomery Earned Income Tax Credit.

320 tax rate for residents who live in Montgomery County 125 tax rate for nonresidents who work in Montgomery County Residents of Montgomery County pay a flat county income tax of. The credit is equal to 50 of the federal tax credit. Get your refund faster with free e-filing and direct deposit straight to your bank.

Eligibility for residents will be determined by the State of Maryland. The Earned Income Credit or EIC is a credit that is income based and is initiated by filing Maryland income taxes by April 15th of every year. 28 of federal EITC Non-Refundable.

Providing a local earned income tax credit to Montgomery County residents will enable approximately 13600 households to receive an average refund of 330 with a. In the absence of file-specific attribution or copyright. Montgomery County Code Chapter 52 Article I Section 52-11A Effective Date February 1 1986 Contact SDAT in Baltimore MD at 800 944-7403 Senior Tax Credit Description The County.

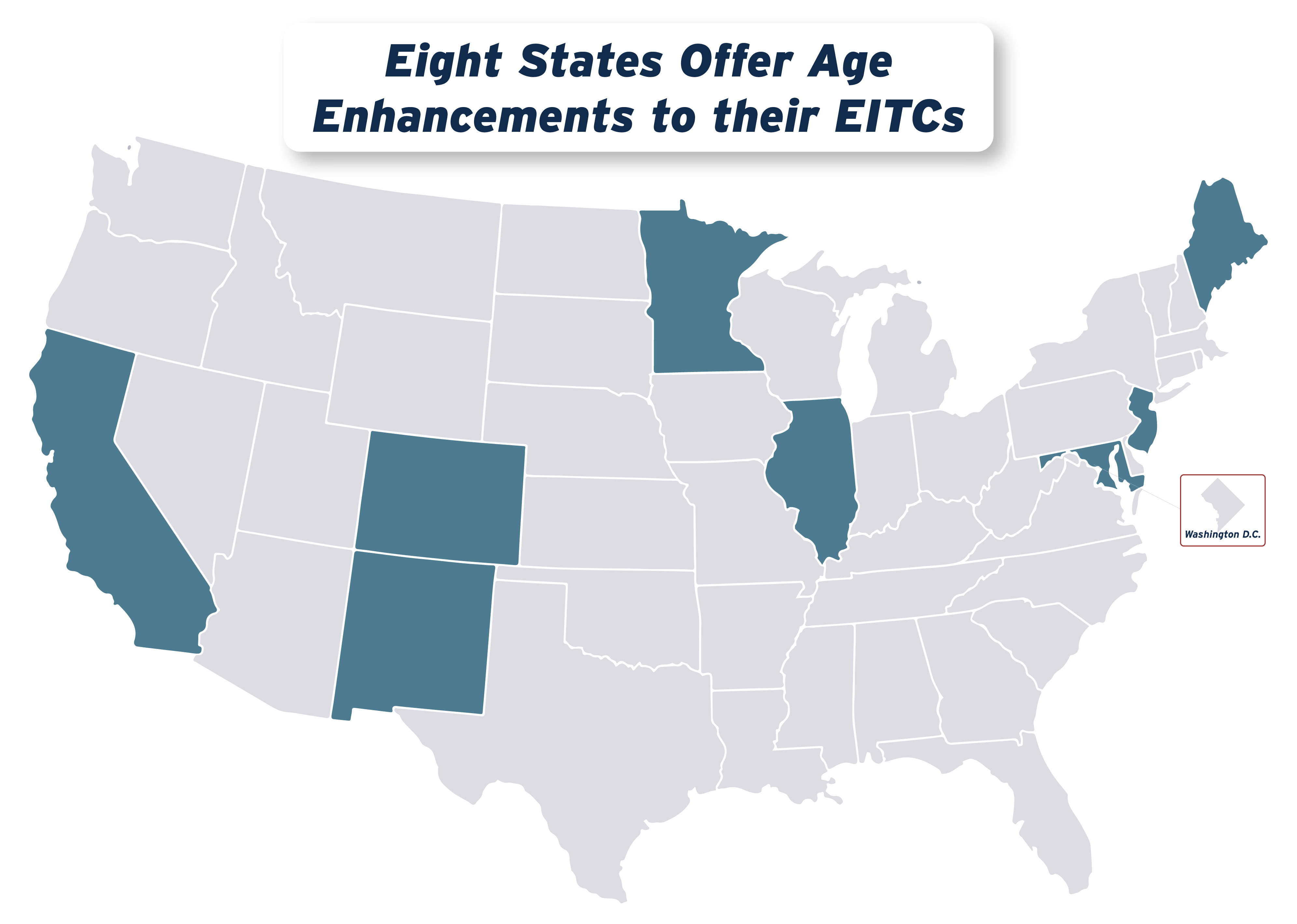

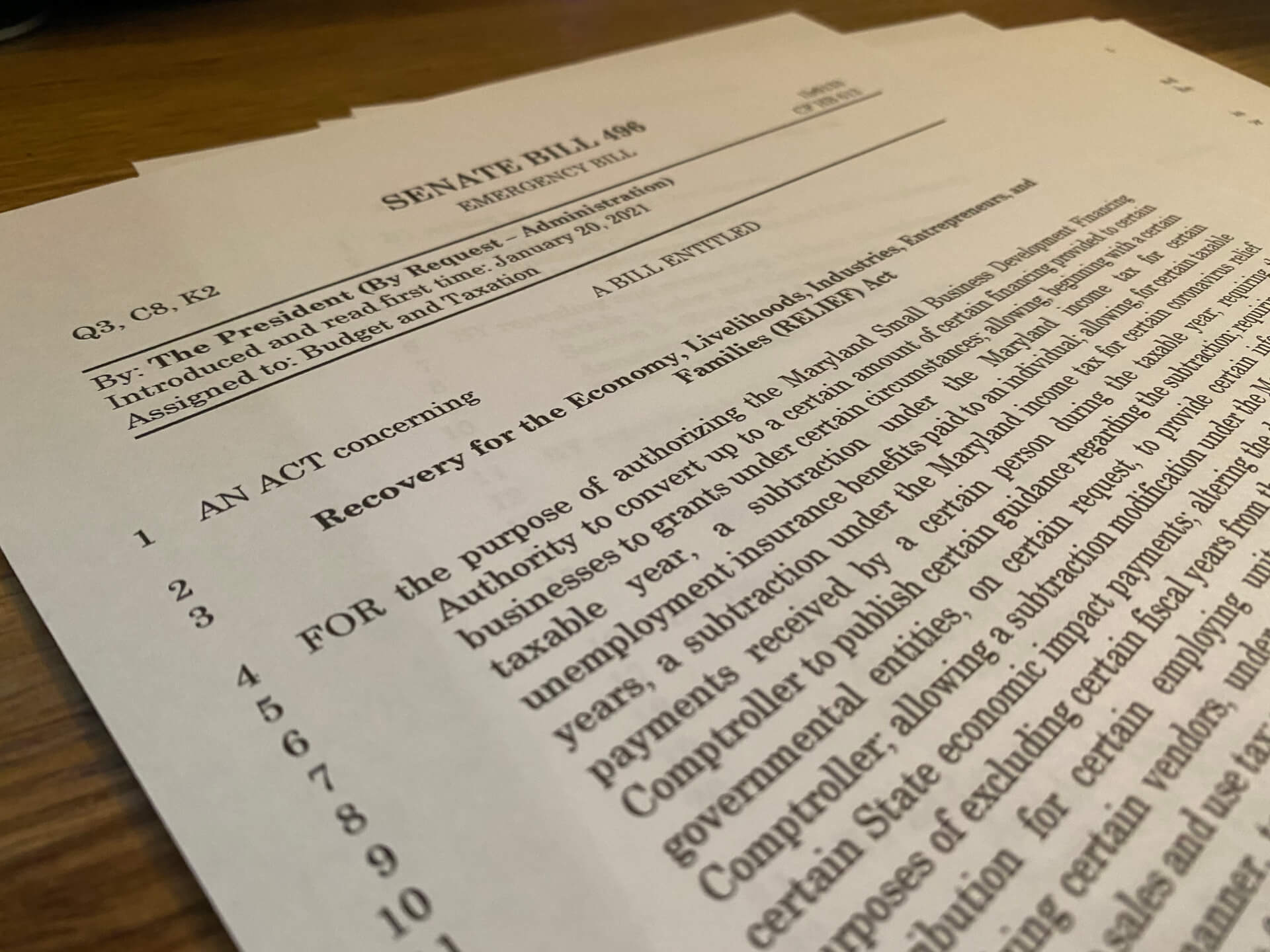

The federal credit is currently. This opens the door to benefits once. In early 2021 Maryland became one of three states to expand EITC eligibility to those who file with an Individual Tax ID Number ITIN.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The maximum federal EITC is 6728. There is a regular State EIC and a.

Radical Tax Cut Proposal Would Spell Disaster For Baltimore Maryland Center On Economic Policy

Earned Income Tax Credit Expansion Quietly Becomes Law Maryland Matters

What You Need To Know About The New Montgomery County Energy Efficient Buildings Tax Credit Program Baumann

Montgomery County Maryland Fire Department Dept Rescue Patch Ebay

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Council Expands Eligibility For County S Local Income Tax Credit Montgomery Community Media

County Executive Elrich Encourages Residents To Get All Your Tax Credits The Moco Show

February 2022 Community Action Agency E Newsletter

Earned Income Tax Credit Wikipedia

Montgomery County Volunteer Income Tax Assistance Program Vita

Low Income Apartments In Montgomery County Maryland

Montgomery County Community Action Facebook

Montgomery County Community Action

House Panels Move Hogan S Relief Proposal With Substantial Changes Maryland Matters

Montgomery County Launches Guaranteed Income Pilot 800 Monthly Wusa9 Com

Montgomery County Volunteer Income Tax Assistance Program Vita

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group